B Break Unsuitable or beyond repair. Up to 1 October 2017 the four categories used included A B C D whereby the level of damage would decrease in severity by category starting from A.

Changes To Insurance Write Off Categories Should You Ever Buy A Write Off Rac Drive

However categories of write off were updated in 2017.

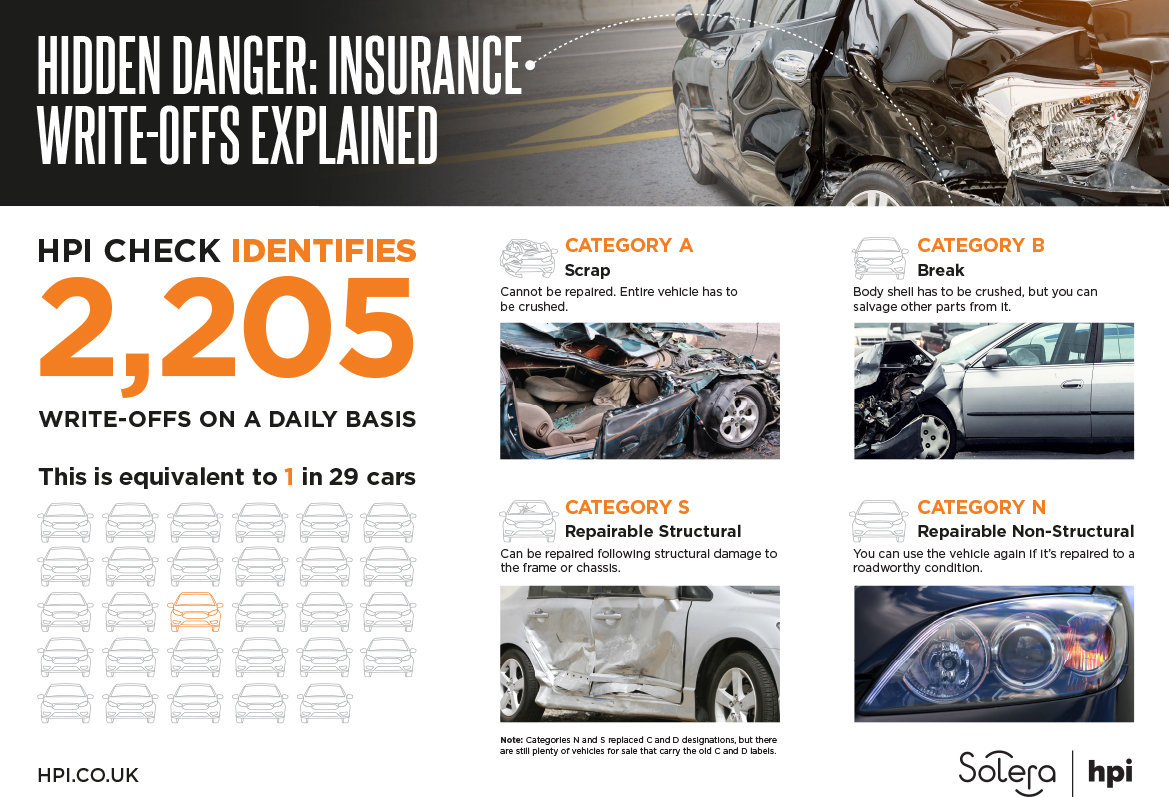

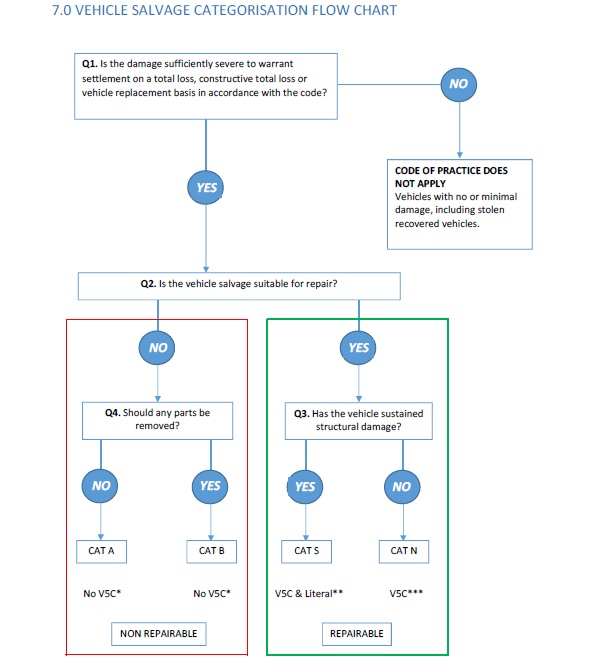

Uk write off categories. Contesting insurance write off categories. Before the current salvage categories A B S and N were put in place there were four original salvage categories A B C and D in use when determining the state of a write-off. Cat S and Cat N replaced C and D respectively.

Category A - Scrap only Category B - Break for parts Category S -. Write-off Categories. They must be completely destroyed.

Write-Off Category S Previously CAT C Cars marked as Cat S have suffered damage to structural areasbut the damage caused is repairable and its possible to make it roadworthy. These were changed in 2017 when the Association of British Insurers changed its salvage code to reflect the structural damage to a car rather than focusing solely on the repair costs. Category S is one of four categories of write-off that insurance companies use to accurately determine the level of damage a vehicle has suffered to cause it to be written off.

Insurance write-off categories explained A new symplified system was introduced in October 2017 and with added reference for motorcycles derivatives and quadbikes From the ABI Association of British Insurers site. Motorists can go ahead and buy a car write off Category C or D as they are deemed repairable despite the insurance company not making repairs. Most Cat B vehicles are destroyed and it is a bad idea to buy one offered for sale.

If youre an experienced driver you should remember that the category N did not exist until Autumn 2007 when the ABI Association of British Insurers introduced new vehicle insurance write-off categories Cat N and Cat S replacing Cat D and Cat C respectively to focus more on the condition of the car than the cost. Category S Previously known as Category C Category N Previously known as Category D What is Category A Write Off. Recovered stolen vehicles which are written-off will also be categorised as A B C or D S or N.

Category N previously named Category D. Wednesday 13 November 2019. In basic terms a Cat S vehicle is one which is deemed to have sustained structural damage including its chassis often as a result of an.

Your insurance companys name and postcode - put these in. The ABI Salvage Code in the UK dictates that Category A and Category B cars should be crushed with Cat B vehicles allowed to donate some safe and serviceable parts. In such cases the insurance company found replacement cheaper than repair to a roadworthy condition.

However write-offs in C D categories can be sold on by the insurance company either to the original owner or to a third party via a car salvage company. Car insurance assessors use various categories of car insurance write-off to rank the seriousness of accident damage. A CAT E Vehicle is a Salvaged Vehicle which has been stolen recovered.

Writing off and scrapping your vehicle is the same as selling it to your insurance company. While vehicle security is improving all the time tens of thousands of cars are still stolen in the UK every year. The most Serious Category.

There are four categories of write-off A B S N but groups S and N used to be known as C and D. However if the vehicle is Category S then a certified Engineer must inspect it and get it re-registered with DVLA. October 2017 Category C and D replace S and N.

A car can be one of four write-off categories depending on the severity of damage. While categories A and B have remained unchanged categories C and D were replaced. A car completely damaged in an accident or fire with no salvage parts comes under Cat A.

There are six different write-off categories although only four are currently used. What is Car Write Off Categories. 6 rows If you want to keep a vehicle in category C D N or S the insurance company will give you an.

While Category A and B cars are not safe to drive and are only suitable for scrapping find out if a vehicle has been written down as scrapped a Cat N vehicle write off is safe to drive after the necessary repairs. Even you do not need to go for a quick MOT test for N category vehicles. There are four main insurance write off categories.

A Scrap Unsuitable or beyond repair and has been identified to be crushed in its entirety including otherwise salvageable parts. However vehicles branded a category F could be returned to the road after being extensively repaired and tested. Category S previously named Category C.

If your cars written-off itll be classed as either category A B N or S. If your car is worth 5000 and the repair-ration value is 50 your assessor has deemed the repair bill in excess of 2500. Cat B vehicles may not be advertised on Free Trader UK.

A car can be assigned to a write off category depending on the severity of the damage and many written off cars find their way back onto the road or the used car market. The groups were changed in October 2017 to take into account the specific type of damage caused and not just the cost of repairs. The insurer awards the write-off classification based on its assessment of the damage but what makes a write-off varies between insurers.

If repair costs were marginally more than 2500 it. Cat B is the second most serious level of damage. In the UK there are four car write-off categories.

Category B Cat B for short is a level of damage used by insurance companies to describe vehicles they have written off. These are cars that have been damaged so badly theyre not safe to be put back on the road. The DVLA will issue a new registration number.

The vehicle is not road worthy and should only be scrapped. You need to enter the following information. Car insurance write-off categories.

The four categories are as follows-Category A. Around half are recovered by police but cars dont always return to their owners in tip-top shape. To successfully appeal you must know your insurers repair-value ratio.

A category F insurance write-off is a fire-damaged vehicle that an insurer refuses to repair. The categories were changed by the Association of British Insurers ABI as they wanted to move the focus away from the total cost of repairing the write off and rather emphasise the.

Old Cat C And Cat D Insurance Write Off Categories Explained Auto Express

What Is An Insurance Write Off Your Guide To Cat A B S C N D Rac Drive

New Write Off Categories To Be Introduced From October 1 Will Stop You Buying A Dangerous Death Trap Motor

Salvage Auction Insurance Write Off Categories Car Co Uk

Insurance Write Off Categories A B S N Insure2drive

Hidden Danger Insurance Write Off Categories Explained Hpi Blog

What Is An Insurance Write Off Your Guide To Cat A B S C N D Rac Drive

Cat A B S And N Cars Insurance Write Off Categories Explained Evo

Did You Know The Write Off Categories In The Uk Free Cars Number Plate Car

Insurance Write Off Categories Set To Change Motoring News Honest John

Cat N Write Off Write Off Categories Write Off History Check

Insurance Write Off Categories Autotrader

Write Off Categories In Uk Explained Cartell Car Check

New Uk Vehicle Write Off Categories Explained Myvehicle Ie

What Are Cat S And N Cars New Insurance Write Off Categories Explained Auto Express

Should I Buy An Insurance Write Off Cat C Cat D Cat S And Cat N Car Explained Carbuyer

What Do The Car Insurance Write Off Categories Mean And How Do I Avoid Buying A Dodgy Used Motor

Car Insurance Write Off Categories Explained Axa Uk

Write Off Categories In The Uk Explained Myvehicle Ie

Post a Comment

Post a Comment